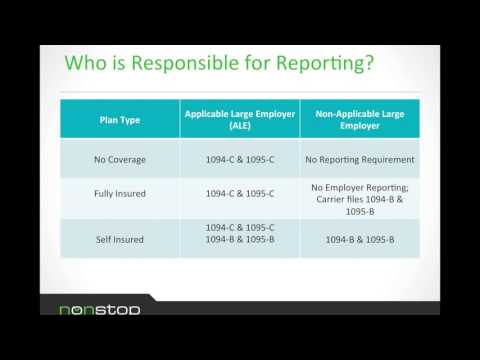

Hi, welcome to our webinar on the new ACA reporting requirements forms 1094 and 1095. Thank you for joining us today. I'm Kristin Donahue, and I'm here with Rachel Johnson. Hello, Rachel! Rachel is one of our principal community liaisons and healthcare brokers, and she will be walking you through the forms today. Just a reminder, this is an executive overview, and we are aiming to keep it to a quick 20 minutes. Our goal is to give you the basic language and knowledge to communicate with your internal team or healthcare broker, as well as other professionals in your team, such as your CPA. We will be covering a walkthrough of the forms, who is responsible for reporting, when reporting is due, and any penalties associated with not reporting. Another reminder is that this webinar is for educational purposes only. Please contact your healthcare broker or tax professional for further counsel. Okay, let's get started. If you look in the right-hand corner, you will see that there is a place to type in questions throughout the webinar. Please feel free to do so. We also had a place to put questions on the registration form, and those of you who entered questions, we will be addressing those throughout the webinar and at the end. We will do our best to get through everybody's questions. With that, I'm going to turn it over to Rachel. All right, so what's new for 2015? For 2015, to be reported in 2016, all applicable large employers (those with 50 or more employees) are going to be required to fill out some new forms for the IRS and furnish them to your employees. Just a quick note, there is some transition relief as far as the employee employer mandate for organizations from 50 to 99. We're not...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 1094 B Taxpayer