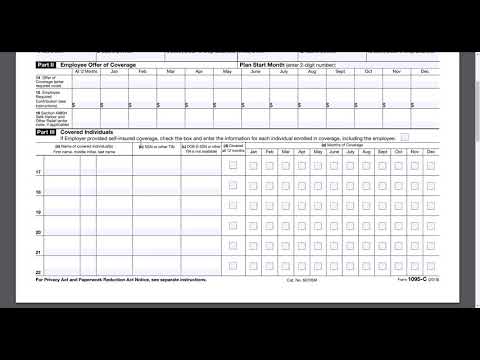

Good morning, everyone! This is Med City CPA, and today we're going to talk about the employer-provided health insurance coverage and the Form 1095-C. Now, this is part of our two-minute tax topic video, where we try to cover a short, specific topic in two minutes or less. Before we get started, I'd like to ask you to hit the subscribe button. Please, for the love of God, hit that subscribe button. I'm trying to get this channel up and running. Okay, that's all I wanted to say. So, what happens if you receive a Form 1095-C? What should you do with it? Well, and why are you receiving them? The 1095-C is generally a form that you receive if you work for a large employer. By large employer, I mean an employer with 50 or more employees. The form states that your employer has provided insurance coverage for you as the employee, as well as for any other covered individuals. It also indicates how long the coverage has been in effect. According to the instructions, you receive this form because your employer is subject to the large employer shared responsibility provision in the ACA. In simple terms, it means that your employer has provided you with insurance. When you fill out your tax return, you might be asked if you had insurance for the entire year. You can refer to this form to answer that question. So, please keep this form in your records as it may be necessary when filing your taxes. Thank you for watching, and don't forget to hit the subscribe button. This is Med City CPA, going over the Form 1095-C. Have a great morning.

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 1094 B Pros