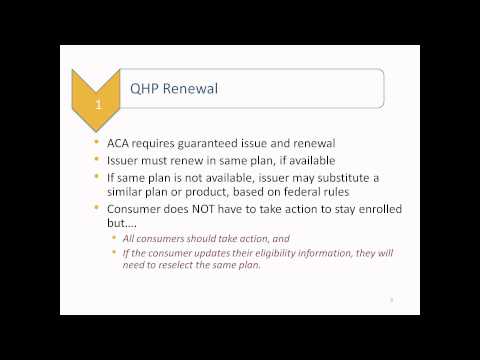

Renewal, but presenting today is Joanne VOC from the Center on Health Insurance Reform at Georgetown University Health Policy Institute. Let's welcome Joanne. Whatever, one thing thank you thank you for taking the time, everyone, to join us in some to this webinar. I'm sure you've heard that we are now about a week and a half into open enrollment period for coverage in 2015, and you may have also heard that there's a process for people who are in marketplace plans to renew their coverage. We're going to cover today what's involved with that process and what to watch out for. So there are two different pieces going on here with renewal. One is that the Affordable Care Act requires health insurance companies to renew coverage for everyone that already got a plan to allow them to continue into that plan. The other process going on at the same time is terminating eligibility for financial assistance if people had premium tax credits with their coverage last year. For the renewal of your marketplace plan, notice qualified health plans or QHPs, as I said, the Affordable Care Act requires insurers to provide coverage to anyone that applies regardless of their health status or pre-existing conditions and then at the end of the plan year to automatically renew it. In the past, insurers used to cancel coverage if they didn't like the claims that were coming in on someone. That's no longer an option, so the insurer must renew the person in the same plan if that plan is available. But if it's not available, the law gives the insurer some flexibility to substitute a similar plan or product based on federal rules without lining how they can make substitutions. So you end up in a plan that's similar to the one...

Award-winning PDF software

Video instructions and help with filling out and completing Who Form 1094 B Eligible