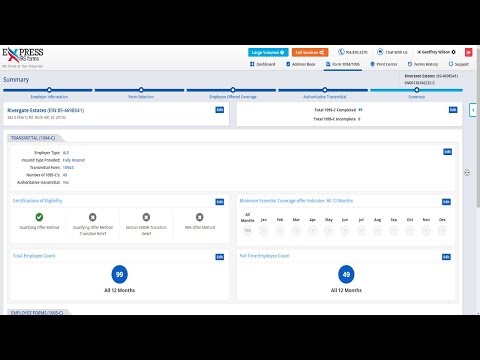

Welcome to Express IRS Forms, one of the fastest and easiest IRS authorized filing programs for ACA reporting Form 1095-C on the market. At Express IRS Forms, we offer a hassle-free e-filing solution for Form 1095-C. However, here's a quick update: the Internal Revenue Service is changing the deadline this year for Form 1095-C. The IRS is not requiring our filers to submit their 1095-C forms by May 31st, so make sure you're completely prepared to have your 1095-C forms filed on time. Express IRS Forms can help guarantee that your 1095-C forms are in the hands of those who need them by the time they're required to have them. To register for Express IRS Forms, visit expressIRSForms.com and click "Register" at the top right of your screen. Enter the necessary account information to create your account. After creating your account, start your 1095-C forms by clicking "Start Now." First, pick your organization's name from the address book or add a new one by manually entering their information below. Choose whether you will be filing this organization as an employer or an insurer. Review the organization's name, EIN, address details, contact details, and signing authority. Then, click "Next." Is your group a member of an aggregated group? Select "Yes" if you are a member of an aggregated group and input your aggregate group details. If not, just select "No" and click "Next." To help us decide on the appropriate form that needs to be filed, please indicate the type of insurance sponsored by the organization. Enter your full-time employee count. To determine if you are an applicable large employer, we recommend using our worksheet for full-time employee calculation. If you know which form to file, click "I know which form to file based on my entry. I'll proceed to file Form 1095-C...

Award-winning PDF software

Video instructions and help with filling out and completing When Form 1094 B Refund