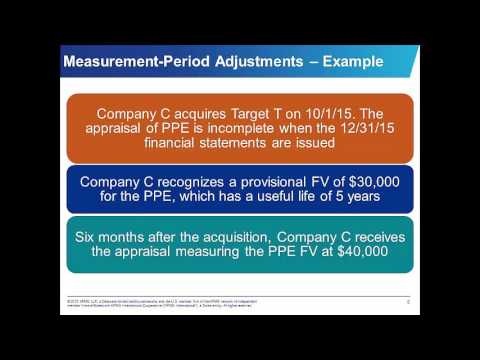

Welcome to our podcast on ASU number 2015-16, which focuses on simplifying the accounting for measurement period adjustments. In this podcast, we will compare the current US GAAP requirements to the amended guidance, provide a quick reminder of what the measurement period is, and describe the new required disclosures. My name is Paul Fahad, and joining me in this podcast is Casey Miles. We are both senior managers in KPMG's department of professional practice in New York. Thanks for tuning in! ASU released this guidance in September 2015 as part of its simplification initiative. As such, the provision of the standard is expected to reduce costs and complexity for reporting entities while maintaining the usefulness of the information for users of the financial statements. Paul, maybe you could walk us through some of the ways the ASU will impact measurement period adjustments. Sure, Casey. Under current guidance, if the initial accounting for a business combination is incomplete by the end of the reporting period in which the combination occurs, the acquirer reports provisional amounts for the items in which the accounting is incomplete. Then, during the measurement period, when more information is obtained about facts and circumstances that existed as of the acquisition date, the acquirer must retrospectively adjust the provisional amounts recognized at the acquisition date to reflect that information. This adjustment also affects goodwill. Additionally, the acquirer must revise comparative information for prior periods presented in financial statements, including making changes to income effects as a result of changes made to provisional amounts. To simplify and reduce the accounting for adjustments made to provisional amounts recognized in a business combination, the ASU requires the acquirer to recognize measurement period adjustments to provisional amounts in the reporting period in which the adjustments are determined. The acquirer would also record the...

Award-winning PDF software

Video instructions and help with filling out and completing How Form 1094 B Entities