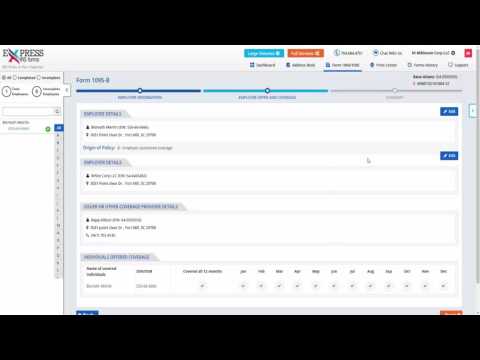

Welcome to Express IRS Forms, your premier online tech solution for filing your IRS information returns accurately and easily. While we all want to assume our ACA forms will be found correctly, it's understandable that some forms may come back rejected. With Express IRS Forms, it's easy to file a correction for your ACA forms when your return is rejected. Our system pulls the forms with the error for you to fix and takes you step-by-step through the process of retransmitting to correct your ACA forms. To begin, log into your account and click "Make Correction" on your Express IRS Forms dashboard. Now, choose if you wish to correct the transmittal form or employee forms. If it's employee forms, select the employees you want to correct and then click "Start Corrections". Here's what can be corrected on each form, so you can double-check before e-filing. For the 1095-B form, you are able to correct the responsible individual details, employee details, employer details, and covered individuals details. To correct any of this information, simply click the "Edit" button and make the appropriate changes. After making the necessary adjustments to your form, click "Save" and proceed to transmit the form to the IRS. This video was brought to you by Express IRS Forms, the IRS authorized ACA compliance and reporting division, and market leader for 1099 and W-2 forms. Please do not hesitate to contact our dedicated support team in Rock Hill, South Carolina if you have any questions or need further assistance.

Award-winning PDF software

Video instructions and help with filling out and completing Fill Form 1094 B Excepted